Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:09

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:33

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Kvartalne analize

Kvartalni outlook i pregledi koji osvetljavaju najvažnije makro i tržišne trendove i trendove koji pokreću tržište roba.

Ukupno analiza

266

+5 u poslednjih 30 dana

Nedavne analize

0

Objavljeno u poslednjih 7 dana

Najpregledanije

6981

Ukupan broj pregleda

Trendovi

Region

Najtraženija tema

Filteri

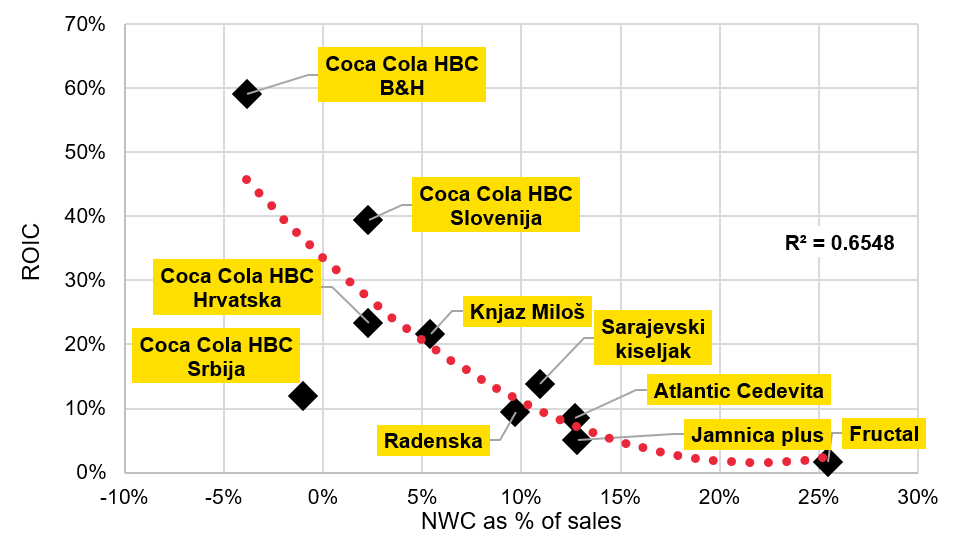

Soft drinks industry - Unparalleled margin and ROIC profile

Generally rising prices within the region haven’t skipped the beverage segment. Strong consumer demand in the Adria region supported the upside in the prices, allowing the producers to copy their rising costs to their selling prices. In this part of the analysis, we aim to gauge the main drivers of the non- alcoholic beverages price puzzle.

12.01.2024.

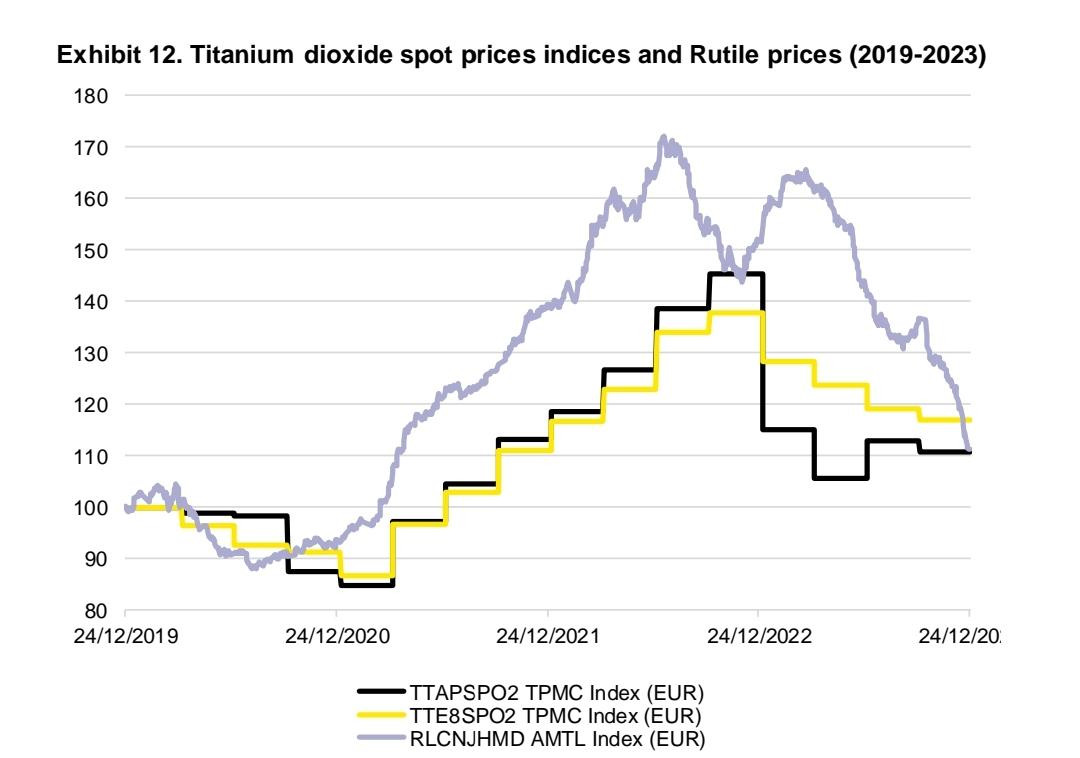

Chemicals industry - Decoupling swift sales growth and depleting profitability

The chemicals sector is driven virtually entirely by end user industries. Chemicals are a key input in a wide array of industries including agriculture, construction, automotive, electronics, healthcare etc. Therefore, our analyses focuses heavily on chemicals end use in order to gauge industry trends and benchmark performance.

05.01.2024.

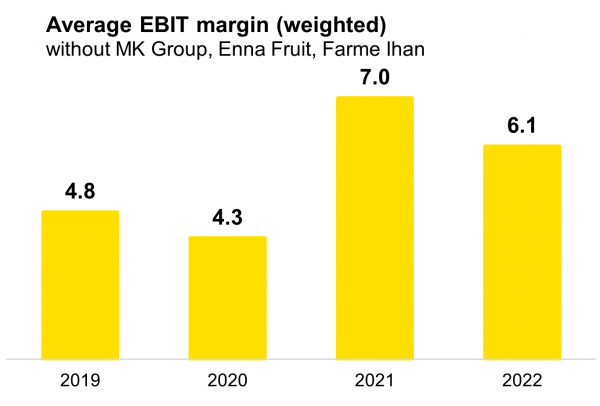

Agriculture industry report: Fertile finances – harvesting higher sales growth and profitability

Despite complex post-covid macroeconomic environment, agricultural companies managed to retain stable course that is evidenced in growing sales figures, improving profitability and growing margins. However, with full storages and decreasing trend of sales prices of crops, we do not expect the continuance of profitability growth going ahead.

18.12.2023.

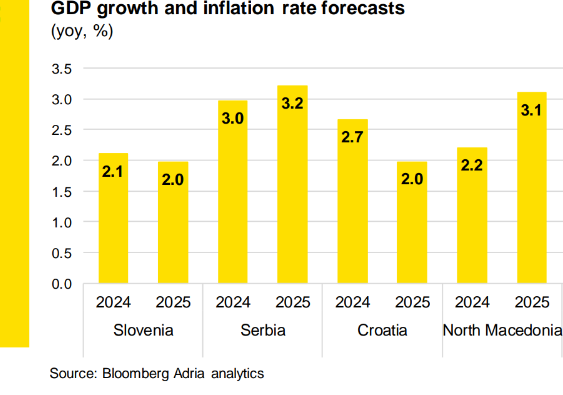

Adria Region Macro Quarterly 1Q 2024 - Economy on a steady course

Our latest report summarizes the effects of higher personal consumption and recovering foreign component of the gross domestic productin the Adria region countries we see in 2024. Unlike many parts of Europe, it seems that the region has successfully avoided recession, as domestic conditions proved to be much more resilient.

08.12.2023.

Interest rates and Financial Market outlook 2024 - Bonds to shine in 2024

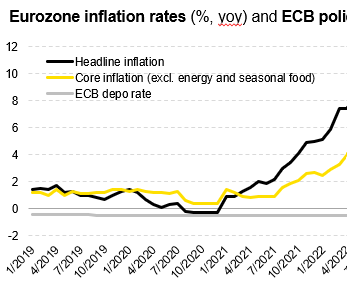

Interest rates push coming from the ECB and FED has entered into a flat territory. This doesn’t mean that the restrictiveness is on hold, as higher levels of interest rates achieved so far provide support for the transmission mechanism to keep rolling.

01.12.2023.

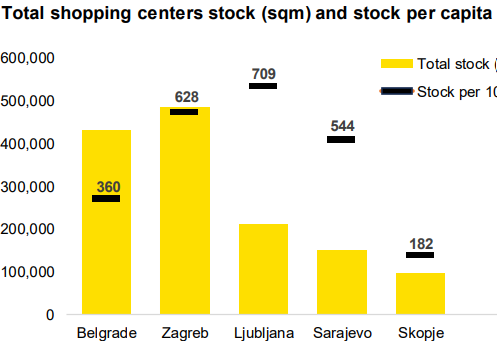

Commercial real estate - retail: Window shopping materializes into lively sales growth

The retail real estate industry has undergone its most significant transformation in history, and the cause can be traced, in its initial steps, to restricted movements during the pandemic and subsequently to changes in consumer behavior, with an essential part of the progress being the rise of e-commerce.

24.11.2023.

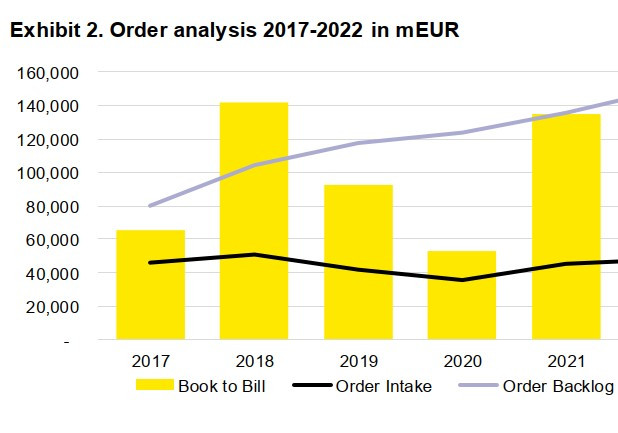

Adria region Electrical Equipment Sectoral Analysis - Power surge in sales, power sag in profitability

This report scans the electrical equipment in Adria region from production and distribution market ends. We zoom in on the businesses within the electrical components and equipment sector which facilitate the availability of power distribution and renewable energy generation/transfer.

17.11.2023.

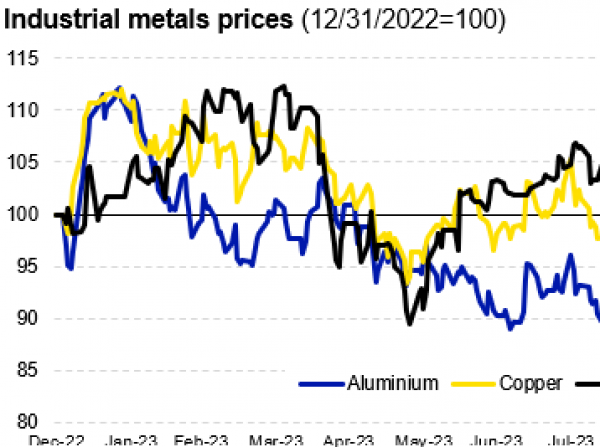

Commodity report - The golden age is not the age for the gold

Commodity market shows mixed picture during 2023. Agriculture and energy are stabilizing compared to rocky 2022, while precious metals benefit from their inflation hedge properties in the light of still elevated inflation, recessionary environment and geopolitical tensions.

09.11.2023.