Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:09

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:33

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Filteri

Equity, bonds and interest rates - Still some upside for equities, cloudier outlook for bonds and MM funds

In the Adria region, equity indices have seen consistent growth, driven by a strong economic expansion in most areas except for B&H, where indices are currently considered overvalued. This growth is largely attributed to increased sales and improved margins among listed companies. On the other hand, bond prices have experienced a year-to-date price drift in 2024, reflecting inflation volatility and the delay in implementing interest rate reductions.

17.05.2024.

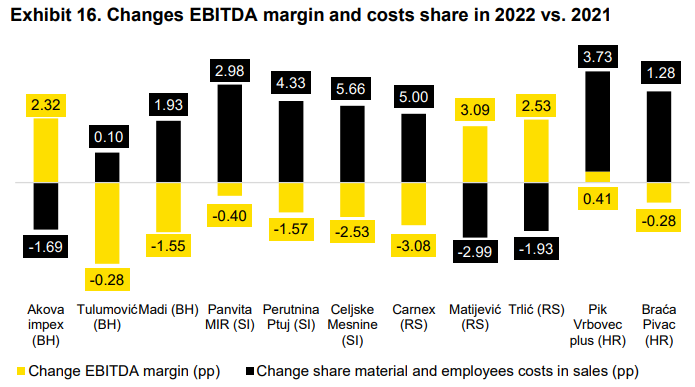

Meat industry: Grilling the numbers – a deep dive into the industry trends and challenges

The Adria region is strongly dependent on meat imports. The average coverage ratio of meat in the region is only 25%. Slovenia leads the scale with 46% coverage in 2023, while the rest fall below, especially North Macedonia and B&H with only 10% coverage.

10.05.2024.

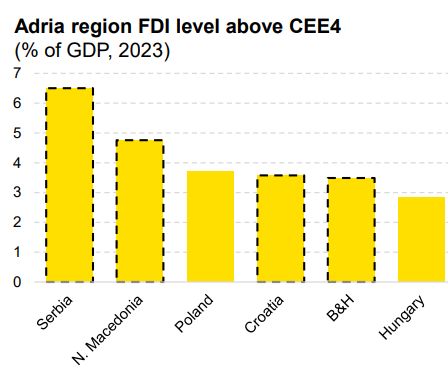

Foreign direct investments Adria region - FDIs to rebound in 2024

The Adria region has been successful in attracting foreign investments in the previous years, accounting for almost 10bln EUR in 2023, or twice as much compared to pre-pandemic 10y annual average. Favourable geographical position in Europe, development potential based on labour force availability and the increasing globalization and nearshoring have been the main factors behind the strong foreign investments.

26.04.2024.

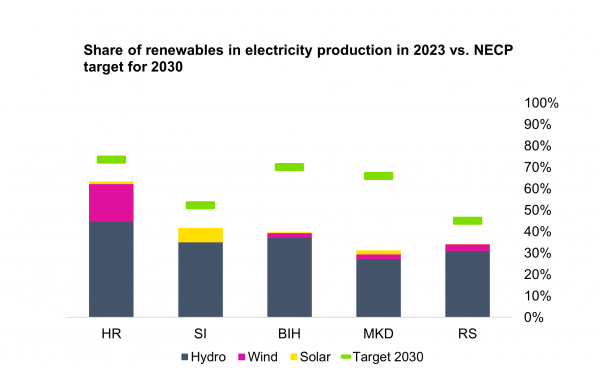

Wind & solar industry report - Unlocking the Adria potential - harnessing untapped wind and solar energy

Renewable energy sources have recorded remarkable growth over the past decade, with wind and solar production capacities expanding at an annual compound rate of 13% and 26% (respectively) globally. In Adria region, in 2023, capacities reached 2.3GW for solar and 1.9GW for wind, which is by 687% and 455% (respectively) higher level than ten years ago. The expansion of solar and wind capacities was propelled by government measures, cheaper investments and attractive investment returns.

21.04.2024.

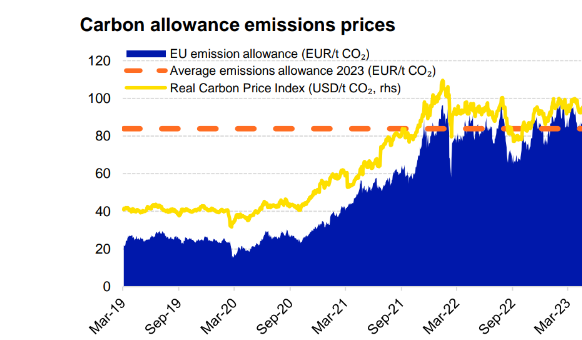

Carbon emissions - Long (and expensive) way to net zero

In this report, we focus on the EU system, known as the EU ETS (EU Emissions Trading System), which is the largest global system in terms of market value, accounting for approximately 87% of all traded carbon allowances in 2023. While Climate ETFs are already at 550 USDbn (30% of ESG ETFs), the current market value of carbon ETFs is around 1 USDbn (given the recent drop in carbon permits prices).

11.04.2024.

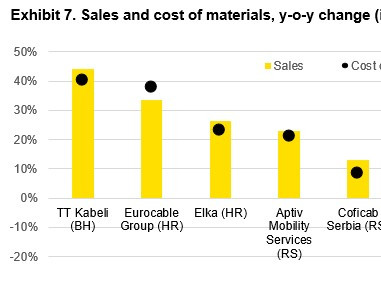

Cable production industry: Cashing in on connectivity – cable producers plug into solid sales growth and sound profitability

This report takes a deep dive into the regional cable industry. Our peer group can be broadly divided into two segments: automotive players and general-purpose cable producers which serve a multitude of industries like construction, energy distribution, etc.). In any case, both subgroups managed to retain steadfast sales growth (beating input cost inflation) and defend solid profitability.

04.04.2024.

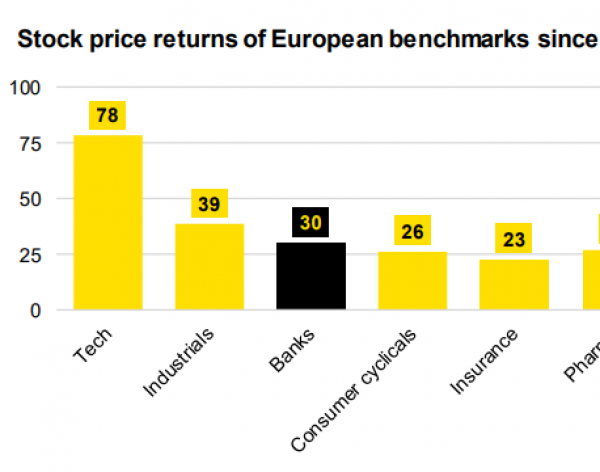

Banking industry - 2023 profitability rise unlikely to repeat soon

Industry-wise, European bank stocks were amongst the best performers since end-2022. This is not surprising since, in 2023, large cap banks in Europe delivered the highest net interest margins (median of 1.9%) in at least 20 years, the highest returns on equity (median of 14%) since 2007 and the highest dividend payout ratios (median of 45%) since 2018.

27.03.2024.

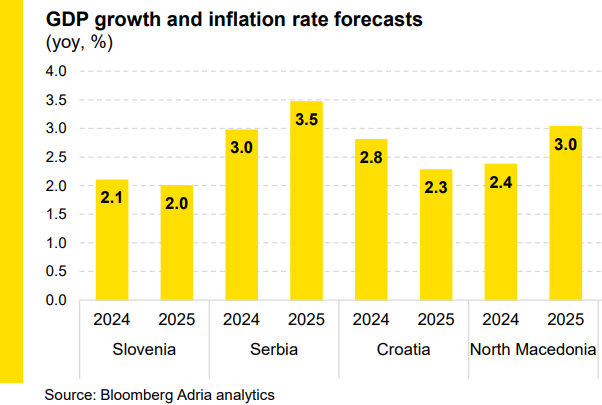

Adria Region Macro Quarterly 2Q 2024 - Solid growth rates labour dependant

In general, the Adria region countries showed resilience during current global recessionary wave. Even though the external demand posed an impediment to more vivid growth, firm domestic factors have predominated and kept the region on the growth path. Aside from solid domestic demand, investments are contributing positively due to solid infrastructure projects within the region and growth in building construction activity.

22.03.2024.