Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:09

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:33

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Kvartalne analize

Kvartalni outlook i pregledi koji osvetljavaju najvažnije makro i tržišne trendove i trendove koji pokreću tržište roba.

Ukupno analiza

266

+4 u poslednjih 30 dana

Nedavne analize

0

Objavljeno u poslednjih 7 dana

Najpregledanije

6982

Ukupan broj pregleda

Trendovi

Region

Najtraženija tema

Filteri

Construction and real estate - Mixed performance from construction activity, real estate prices soaring

Latest available data shows construction activity slowing down or falling in most countries of Adria region, except for Slovenia, where activity is maintaining strong pace.

31.10.2022.

Foreign trade of goods - Region facing deteriorating foreign trade prospects in the wake of 2023

Latest available data (August 2022 for all, except Bosnia and Herzegovina, which is September), point to a still strong, double-digit growth rates for both exports and imports in the Adria region, however, prospects are bleak.

31.10.2022.

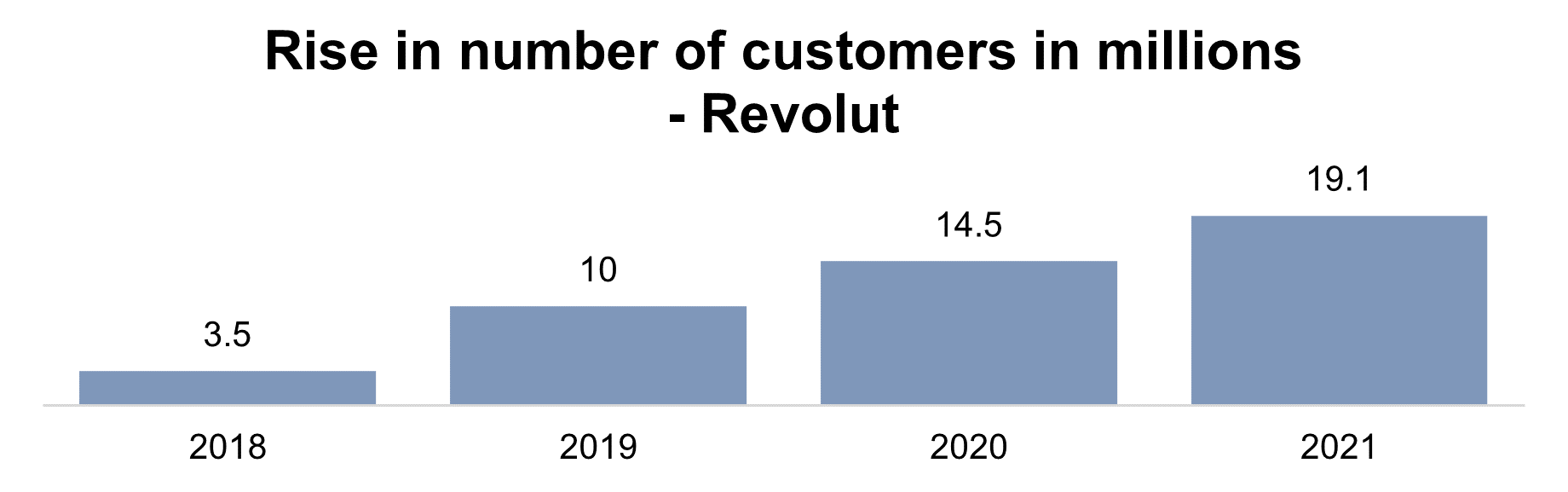

Fintech industry

The region is characterized by widely varying adoption rates of fintech solutions and the prevalence of fintech initiatives. Our analysis focuses at regional leaders in fintech industry compared to benchmark players on a global scale in order to gauge the overall market direction for the local players going forward.

25.10.2022.

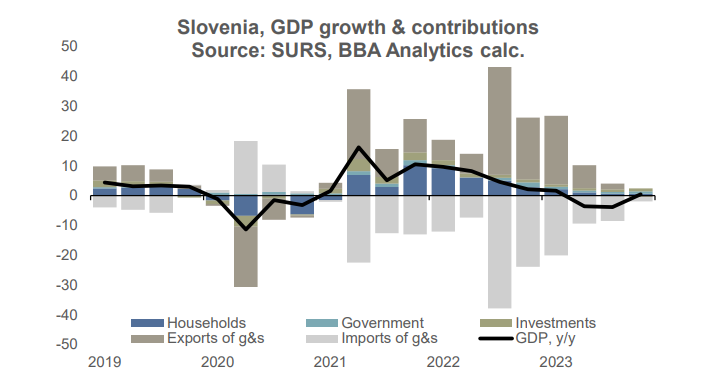

Adria Region Macro Quarterly 4Q 2022 - Economic Cool-down Gains Traction

After an astonishing economic activity outcome since start of 2021, Adria region is seeing the GDP growth profile weakening by end of 2022 and especially in 2023. The real GDP growth will shape a mixed picture, with negative rates in Slovenia and only a symbolic drop in Croatia combined with small single-digit positive real GDP growth numbers in the rest of the region.

19.10.2022.

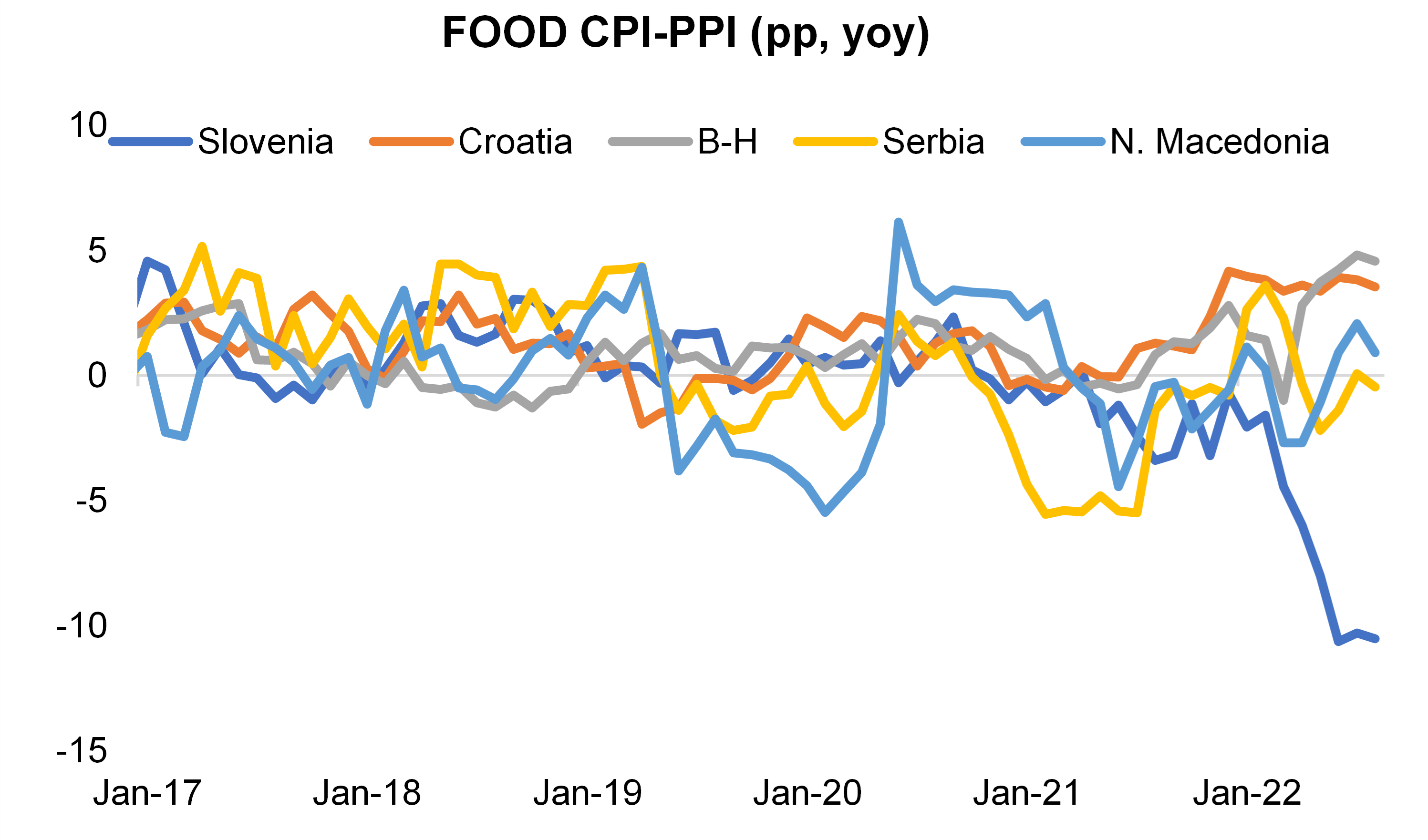

Food & beverage industry

Last couple of years have been demanding for all industries, bearing in mind that the COVID-19 environment is not something formerly experienced by any market participants. Even the F&B industry, which deals in basic foodstuffs and is less exposed to economic turbulences than other industries, was affected by certain headwinds across diverse branches. To best display inter-sectoral dynamics, our analysis focuses on forming peer subgroups (beverages, meat, bread and dairy) and addressing the principal trends and challenges they've encountered in the previous years and ultimately, providing a forward-looking expectation in these unprecedented times.

17.10.2022.

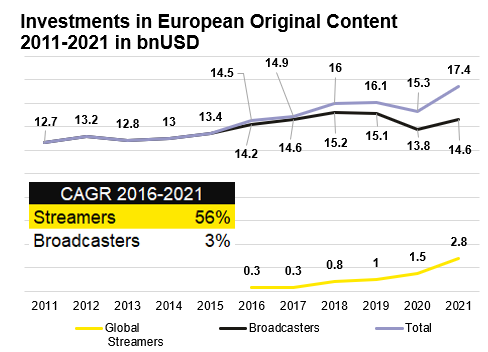

Frame by frame - The upside of 3D Animation in the region

The rationale behind the analysis undertaken is that there is a strong upside for 3D animation due to increasing rates of content produced. The Adria market is also relatively untapped and shows promising growth potential. The main factor going for Adria Region players is their cost competitiveness. We believe that the rising amounts of visual content produced for various end uses will spill over in terms of higher demand for 3D animation services in the region.

12.01.2022.