Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:09

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:33

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Filteri

Coffee industry: Challenges persist, but the worst is behind

The objective of this report is to analyze the coffee industry through the lens of coffee processors. The report will examine the historical financial performance of significant regional players in coffee processing. It will offer insights for raw coffee prices

15.03.2024.

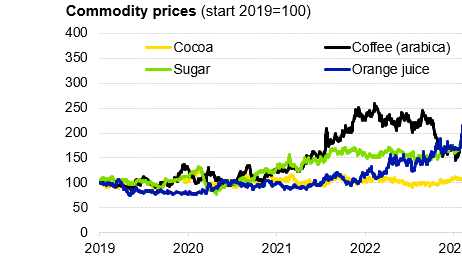

Special commodity report - Will sweetness turn to bitterness?

The prices of most commodities have returned to 2019/2020 period levels, but certain commodities are experiencing significant price hikes. The primary factor behind this growth are adverse weather conditions (in important regions for production) and different diseases. Since the start of 2019, the prices of cocoa, orange juice, sugar and coffee have risen by 140% on average. The orange juice stands out, which price surged by 200% followed by cocoa at 160%, which price particularly accelerated in 2024.

08.03.2024.

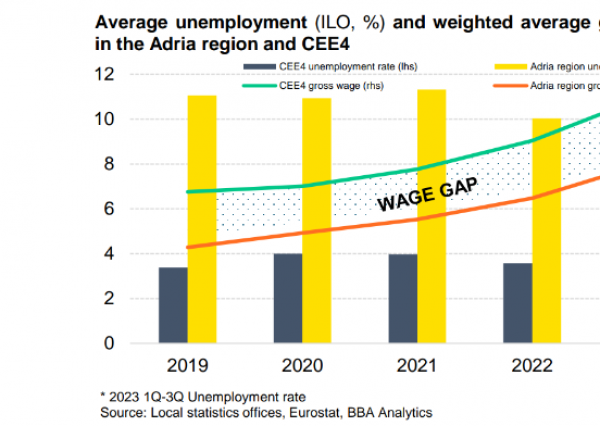

Labour market - Productivity struggling to converge to EU

In 2023, gross wages continued to grow, supported by high (albeit declining) inflation rates and a lack of labour. The growth rate in both the Adria region and the CEE4 in nominal terms was over 13.5% on average. Except for Czechia and Slovenia, gross wage growth recorded double-digit numbers. In real terms, the situation is better for the Adria region, where the average real wage growth was 4.8% yoy, suggesting better purchasing power, while that was not the case for CEE4 (-0.6% yoy).

01.03.2024.

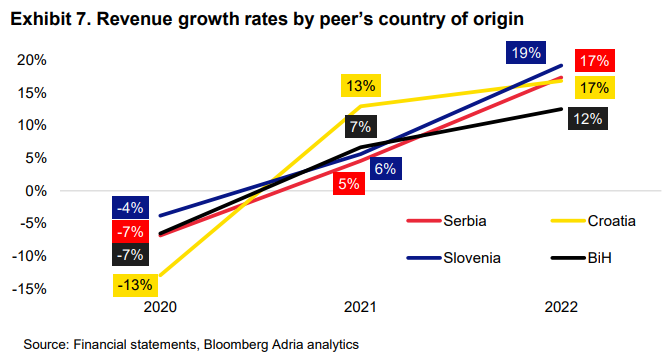

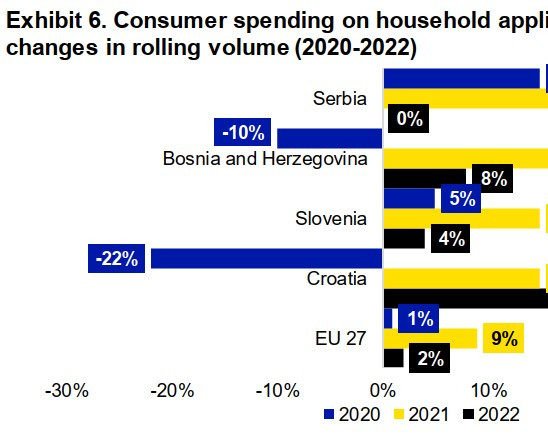

Electrical appliances industry: Reheating yesterday’s lukewarm margins and leftover sales growth

This report hones in on the regional Electrical appliance industry. We look at how different target markets, business models and products ultimately define intra-regional differences in financial performance. We evaluate the financial strengths and weaknesses of the largest regional players and offer our outlook regarding the industry at large.

22.02.2024.

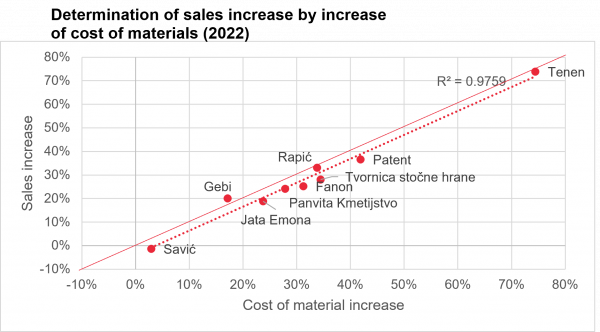

Animal feed industry: Feedstock value potential – defending sales growth and milking modest margins

This report aims to provide a deeper insight of the animal feed industry in Adria region. In addition to microeconomic aspects and analysis of performance of companies within the industry, the report encompasses macroeconomic aspects, due to profound influence that economic fluctuations have on the industry.

19.02.2024.

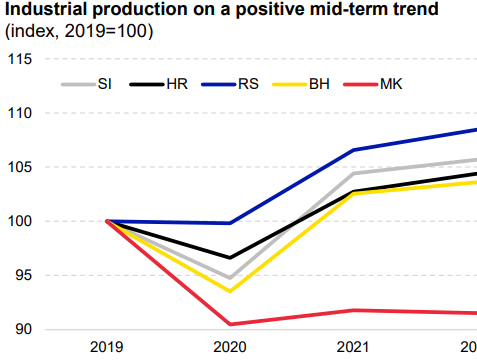

Foreign trade & industrial production - Are you ready for another supply chain headache?

Industrial production in the Adria region stagnated (on average) in 2023, with Serbia on the higher end (+2.3% yoy) and Slovenia on the lower (-5.3% yoy). In this report we aim to gauge the main driver behind its dynamic, and potential going forward.

09.02.2024.

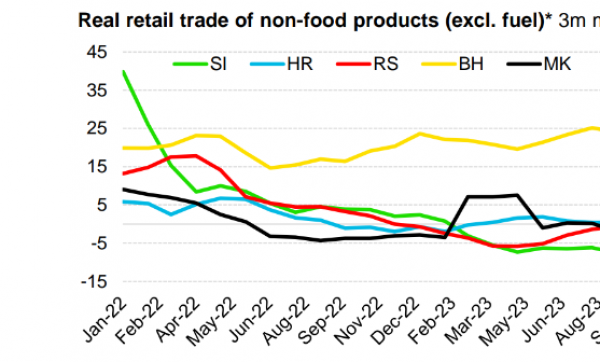

Retail trade - Real wage growth rebound – a push for retail trade

The real retail trade landscape in the Adria region in 2023 presented a mixed picture. Serbia and Slovenia recorded a decline, North Macedonia recorded stagnation, Croatia saw solid growth and in Bosnia and Herzegovina retail trade experienced expansion. Real wage growth is expected to play a significant role in driving retail trade, but the crucial question lies in the extent of its impact. Notably, consumers are becoming more optimistic, particularly concerning major purchases, which encompass the consumer discretionary segment of retail.

02.02.2024.

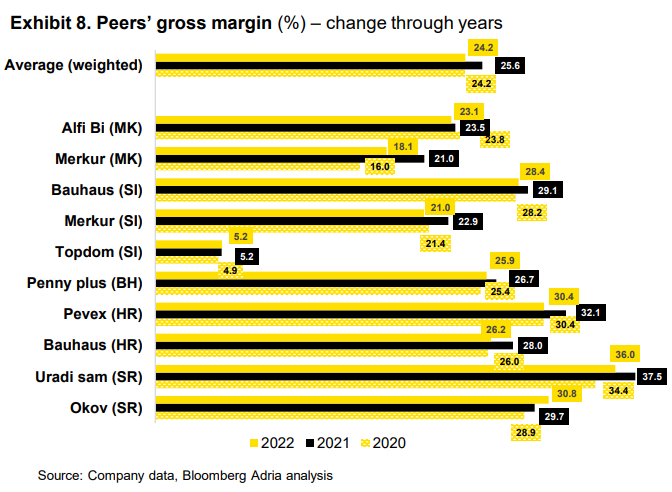

Home improvement industry - Profit followed by higher handmade activities

Overall strong macroeconomic environment in the previous years has contributed to the increasing consumption in the segment of items related to home improvement, surprisingly, even faster than at the EU level. Spending on home improvement or do-it-yourself (DIY) items was sparked during and after the COVID-19 lockdown and the emergence of working-from-home practice as people spent more time inhouse.

26.01.2024.