Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:09

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:33

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Kvartalne analize

Kvartalni outlook i pregledi koji osvetljavaju najvažnije makro i tržišne trendove i trendove koji pokreću tržište roba.

Ukupno analiza

266

+3 u poslednjih 30 dana

Nedavne analize

0

Objavljeno u poslednjih 7 dana

Najpregledanije

7153

Ukupan broj pregleda

Trendovi

Region

Najtraženija tema

Filteri

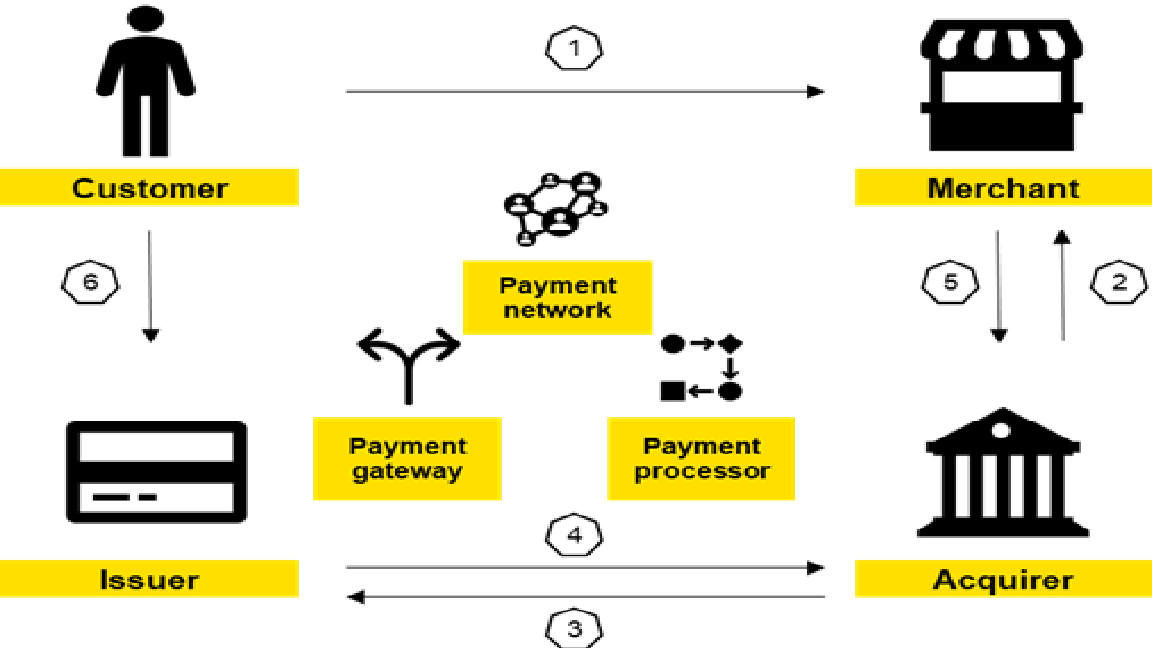

Payment processing industry

With transaction processing being the most widely outsourced service in the banking, in this report we focus on the industry trends and Adria region market development vs the EU peers. We also look into the financial results of the key non-bank payment service providers and examine the business prospects.

03.04.2023.

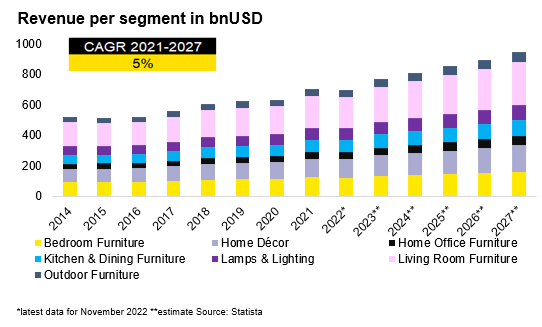

Furniture industry - solid profitability in the Adria Region

The analysis takes a deep dive into the furniture industry in Adria region. It outlines general industry trends as well as the attractiveness of the Adria Region for furniture manufacture. We benchmark the performance of Adria region players (both furniture manufacturers and furniture retailers) with global peers in order to delineate the main drivers and challenges defining the industry currently.

27.03.2023.

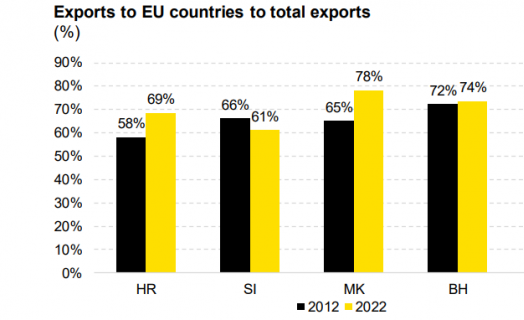

Foreign trade of goods - Foreign and domestic demand still supporting trade at start-2023

Foreign trade of goods in Adria region was very intensive in 2022, mainly due to surging prices, especially commodities’ prices and in the first part of the year. All countries posted deficit in merchandise trade, with the highest one being in Croatia (although mitigated by strong services export).

20.03.2023.

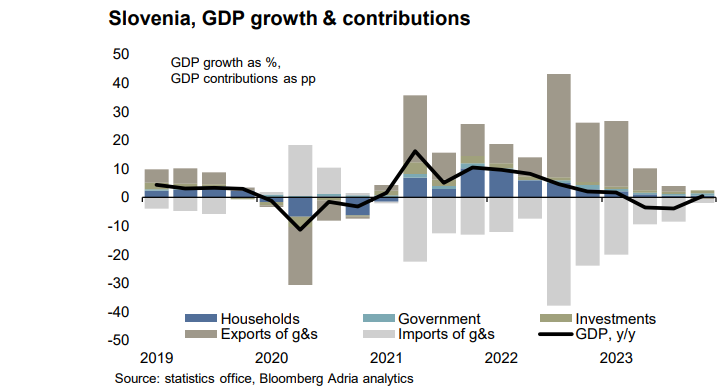

Adria Region Macro Quarterly 2Q 2023 - Better Activity Profile, Inflation Still Weighs

Macro Quarterly Outlook highlights a combination of somewhat better profile for this year's core economic activity, increased inflation forecasts and expectations for more central bank tightening than assumed before. Europe's biggest economies are seeing stronger economic activity than expected before and this is translating into South East Europe as well.

13.03.2023.

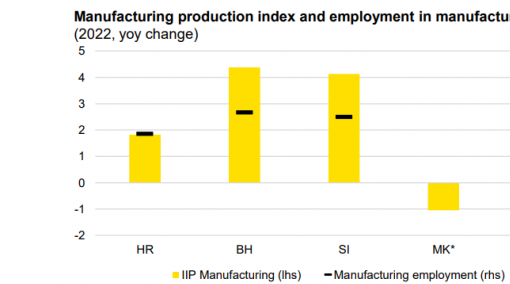

Industrial production - Global economic slowdown biting on manufacturing activity in 2023

Adria region industrial production rose in 2022 (except in North Macedonia), but on a slower pace compared with the previous year although 2021 was post-pandemic rebound year. Countries in the region are producing more than in 2019, with North Macedonia as a sole exception, posting 8.5% lower production level compared to 2019.

08.03.2023.

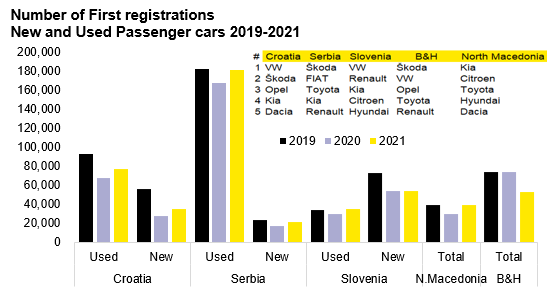

Car dealerships - Defending mid single-digit profit margins

In this report we are looking into performance of the local car dealers in order to display the origins of their profitability, magnitude of the effects of the global supply shocks and how the disconnections in the aggregate supply and demand affected car dealerships’ business results. We also look into how the dispersion in sales of the largest car dealerships in the region reflects consumer sentiment.

02.03.2023.

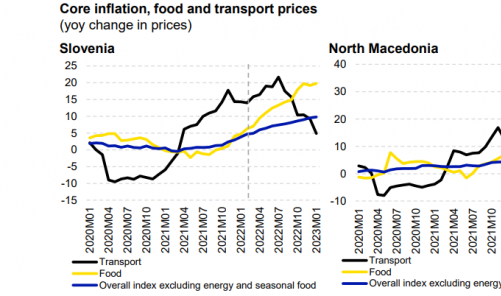

Inflation report - Inflation slowing only modestly in 2023

Headline inflation is slowing down in most of Adria region, with only Serbia being an outlier in the recent months as headline inflation pressures seem to have built up further. On a global view, inflation pressures coming from energy and food categories are easing, especially energy costs with relatively warm winter which in case of Europe meant less usage of gas and electricity.

27.02.2023.

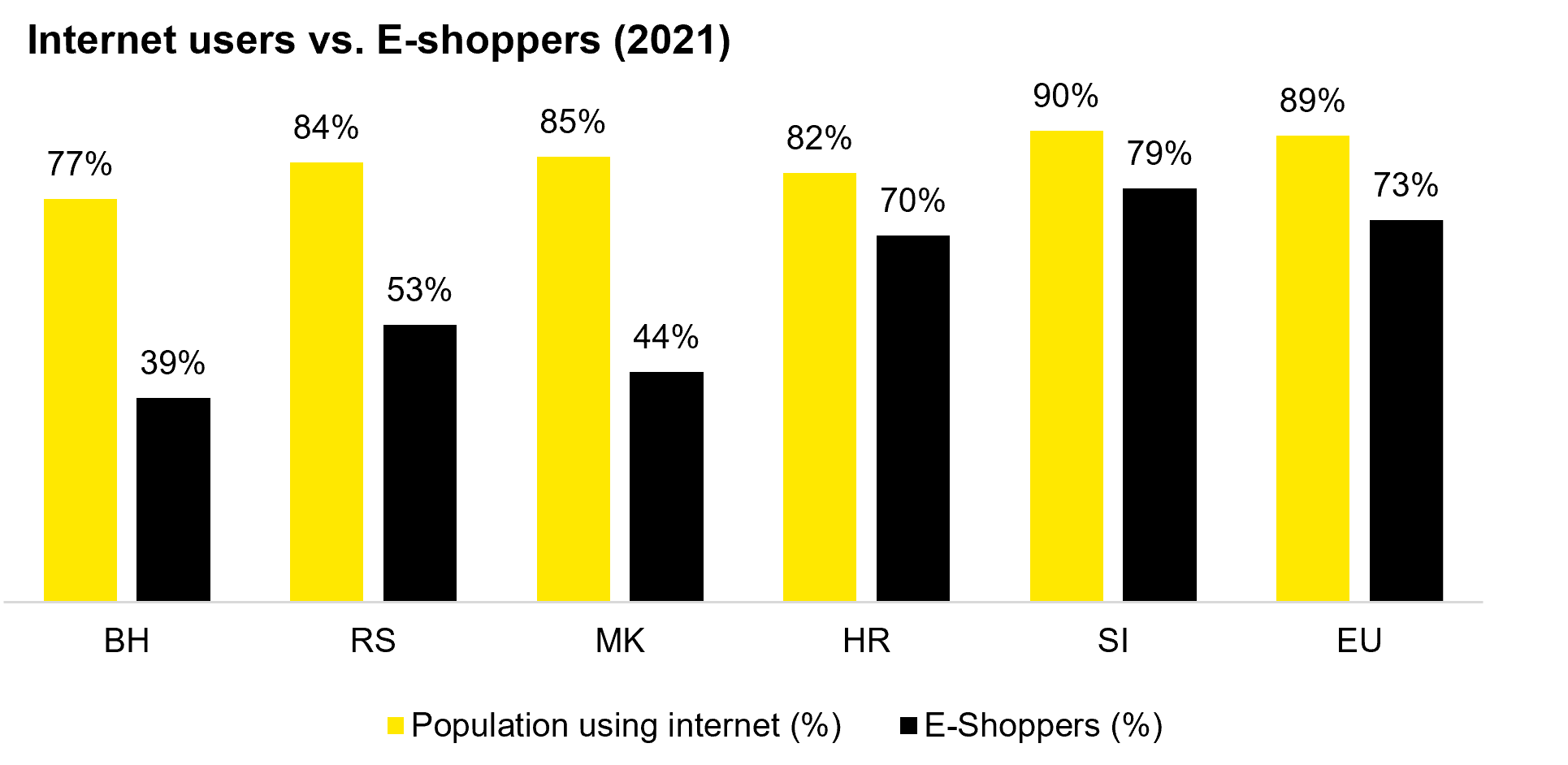

E-commerce industry - Intensifying marketplace competition

E-commerce value has grown rapidly over the past years, with the industry’s growth in mid-teens leading to changes in patterns of traditional retail and distribution business as well. E-commerce development in the Adria region is in somewhat different stages, which comes from different degree of digitalization, characteristics of the market and different economic development between the countries.

20.02.2023.