Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Produktivnost u regiji raste, ali presporo

10.11.2025 10:33

Slabljenje dolara briše zaradu evropskih ulagača u S&P

03.10.2025 12:11

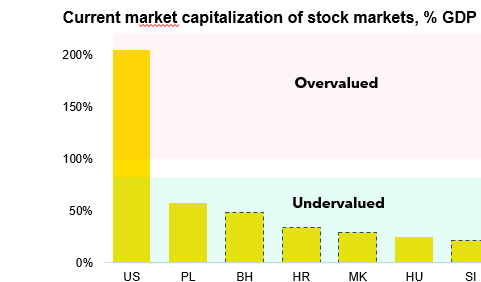

Ko su skriveni dragulji tržišta kapitala u Adria regionu?

23.09.2025 12:38

Stabilan rast u perspektivi, uz spoljne rizike koji ostaju na snazi

23.09.2025 12:33

Kvartalne analize

Kvartalni outlook i pregledi koji osvetljavaju najvažnije makro i tržišne trendove i trendove koji pokreću tržište roba.

Ukupno analiza

264

+3 u poslednjih 30 dana

Nedavne analize

3

Objavljeno u poslednjih 7 dana

Najpregledanije

7139

Ukupan broj pregleda

Trendovi

Region

Najtraženija tema

Filteri

Macro Quarterly_ 4Q 2025- Stable Growth Ahead, External Headwinds Remain

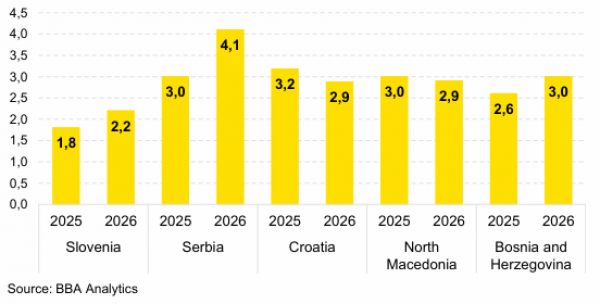

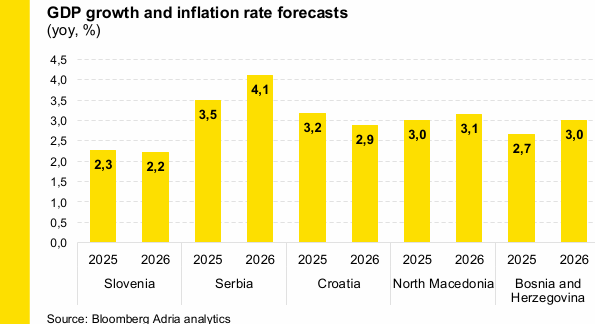

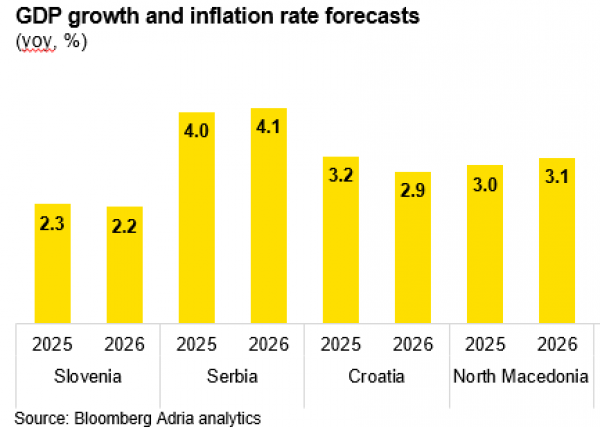

We expect the Adria region to remain on a stable growth path in 2025, supported by resilient domestic demand, rising real incomes, and firm labour markets. Croatia and North Macedonia posted 3.4% y/y GDP growth in Q2, led by household spending and construction. Bosnia and Herzegovina, and Slovenia benefited from strong consumption, though Slovenia's rebound remains fragile due to falling retail sales and weak EU trade. Serbia’s Q2 growth accelerated to 2.1% y/y, lifted by consumption and services, while construction and investment lagged. Across the region, labour shortages remain structural constraints.

22.09.2025.

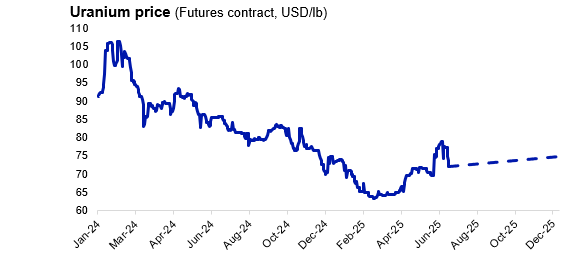

Commodity market - Commodities at a Crossroads: Gold Shines, Oil Slumps, Uranium Waits

After peaking at $107/lb in 2024, uranium prices have corrected sharply to double digit numbers. The sharp pullback has caught many investors off guard; however, the pullback reflects macro-driven sentiment shifts, policy uncertainty, and technical selling, not a breakdown of uranium’s long-term bull thesis. In fact, several core market indicators continue to point to tightening fundamentals, reinforcing the long-term structural case. Rather than signalling the end of the cycle, the current price action appears to be a temporary pause in an otherwise intact uptrend.

11.07.2025.

Adria Region Macro Quarterly 3Q 2025 - Growth holds, but headwinds remain

We expect the Adria region to remain on a stable growth path in 2025, driven by domestic demand, rising real incomes, and solid labour markets. Household spending and construction activity continue to support GDP across Croatia, Bosnia and Slovenia, while Serbia and North Macedonia also benefit from strong credit dynamics. The main drag remains external demand, with weaker EU growth and export volatility limiting the contribution from trade. Workforce shortages remain a common structural issue across all economies.

24.06.2025.

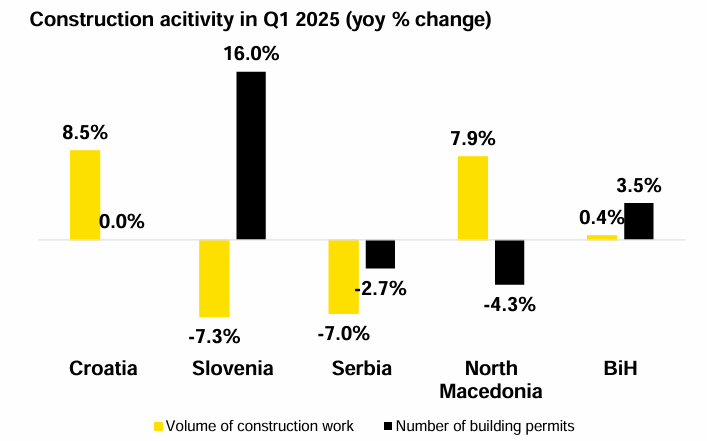

Construction and real estate - Uneven construction trend across Adria countries

Construction activity in the Adria region continues to be primarily driven by residential and non-residential building construction, as the growth rates in building construction are higher than in civil engineering.

29.05.2025.

Markets report - Equity & Bonds - Geopolitical noise, regional signal: why Adria stands out

Year 2025 began with heightened volatility across global financial markets, primarily stemming from the United States, where Trump’s renewed protectionist moves, including new tariffs, have unsettled investor sentiment. Within this backdrop, equity markets in the Adria region have delivered mixed results year-to-date.

29.05.2025.

Adria Region Macro Quarterly 2Q 2025 - Uncertainties elevated, but growth to continue

We expect the Adria region to continue its growth momentum in 2025 and 2026. Domestic demand will continue to contribute strongly due to firm spending fundamentals. Labour markets are tight, and availability of a work force is one of the key issues in the mid term. Main risks to our projection come from the external environment.

13.03.2025.

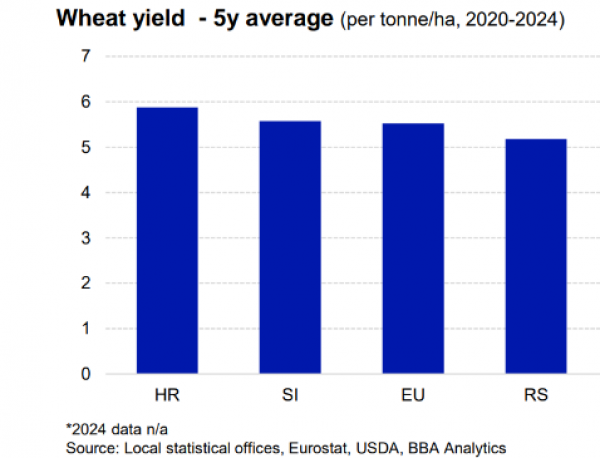

Agri commodity market - Diseases and weather are shaping the prices

The price of sugar has fallen by 17% over the past year. All cereals are highly dependent on weather conditions and Russian/Ukrainian exports. Currently, there are no significant adverse weather conditions or major risks to cereal exports via the Black Sea. As a result, the FAO Cereal Price Index fell by 6.9% year-over-year, with all cereals at lower levels. Meat prices, as measured by the FAO Meat Index, have fallen by 8.1% over the past year.

13.02.2025.

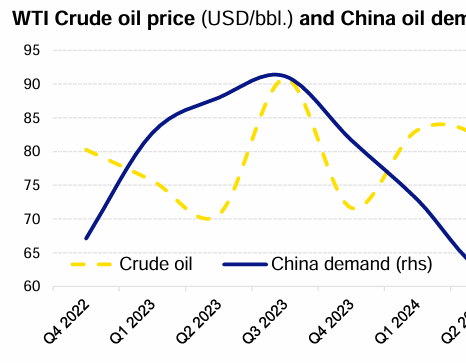

Commodity market - Trump and weather to navigate the prices

Copper and aluminium prices were elevated in 2024. Copper prices were cca 10% higher on average in 2024 (till mid Dec-2024), aluminium 7% yoy for the same period. China is a common denominator for industrial metals, so government stimulus provided a boost to the copper price mid-year. Aluminium exposure to the automobile production sector limits the upside, with protective measures imposed impacting the flow directions.

19.12.2024.