Macro outlook

Adria Region Macro Quarterly 2Q 2025 - Uncertainties elevated, but growth to continue

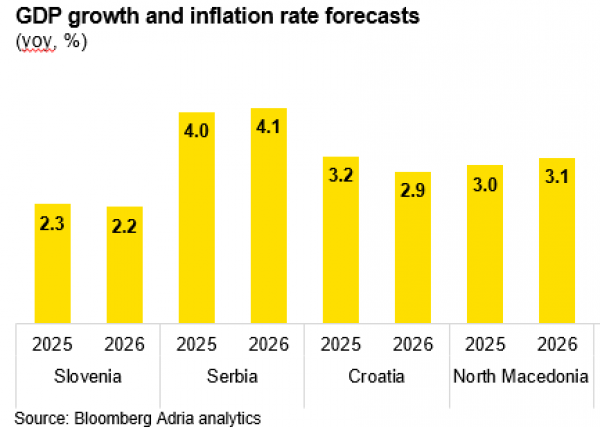

We expect the Adria region to continue its growth momentum in 2025 and 2026. Domestic demand will continue to contribute strongly due to firm spending fundamentals. Labour markets are tight, and availability of a work force is one of the key issues in the mid term. Main risks to our projection come from the external environment.

13.03.2025.

Regional topics

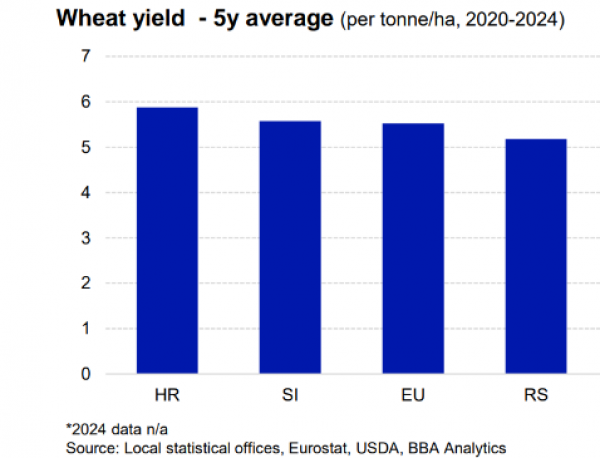

Agri commodity market - Diseases and weather are shaping the prices

The price of sugar has fallen by 17% over the past year. All cereals are highly dependent on weather conditions and Russian/Ukrainian exports. Currently, there are no significant adverse weather conditions or major risks to cereal exports via the Black Sea. As a result, the FAO Cereal Price Index fell by 6.9% year-over-year, with all cereals at lower levels. Meat prices, as measured by the FAO Meat Index, have fallen by 8.1% over the past year.

13.02.2025.

Sectoral analyses

Commodity market - Trump and weather to navigate the prices

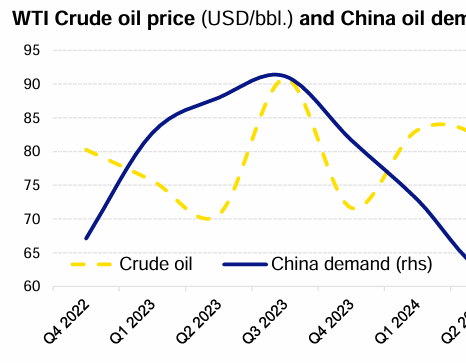

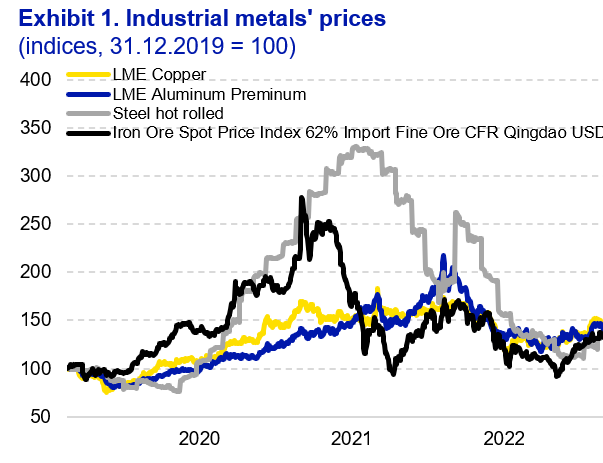

Copper and aluminium prices were elevated in 2024. Copper prices were cca 10% higher on average in 2024 (till mid Dec-2024), aluminium 7% yoy for the same period. China is a common denominator for industrial metals, so government stimulus provided a boost to the copper price mid-year. Aluminium exposure to the automobile production sector limits the upside, with protective measures imposed impacting the flow directions.

19.12.2024.

Macro outlook

Adria Region Macro Quarterly 1Q 2025 - Growth on track, external risks lurk

The Adria region will continue its growth trend, based on stable consumption growth, infrastructure investments, and a external demand rebound. Tight labour markets will support continued wage growth and provide support to the domestic demand, while one of the key risks remain tied to the external demand. Especially, as the crisis in the German auto industry unwinds further, and protective measures spread globally.

12.12.2024.

Regional topics

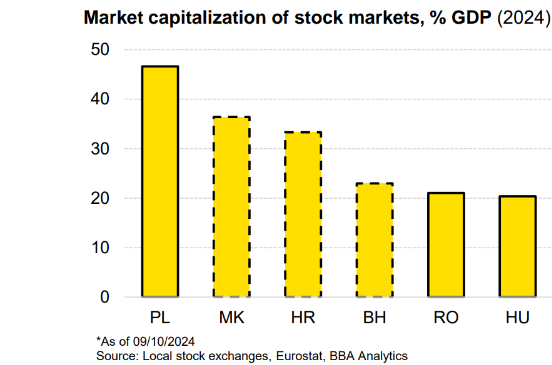

Markets report - Equity & Bonds - Positive trends persist amid solid economic growth

Equity indices in the Adria region have continued their growth year-to-date, outperforming most CEE indices. The only index showing negative performance is BIRS, reflecting concerns of overvaluation. Positive sentiment around moderate real economic growth has translated into improved company results. In terms of bonds, the risk premium has fallen year-to-date compared to German benchmark, further signaling the good shape of regional economies and improved investor sentiment towards Adria region bonds.

18.10.2024.

Macro outlook

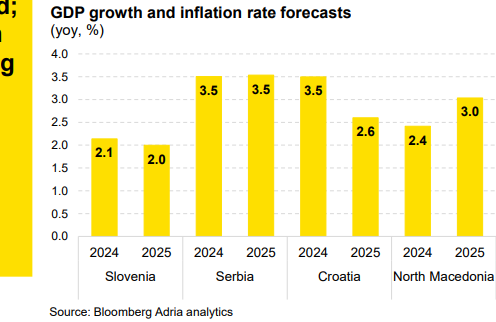

Adria Region Macro Quarterly 4Q 2024 - Moderate growth and stabilizing inflation ahead

The Adria region is seen to experience moderate economic growth in 2024, supported by robust domestic consumption, ongoing infrastructure projects, and improving external demand. This growth is expected to continue into 2025, fuelled by ongoing infrastructure investments, a recovery in external demand, and stable domestic consumption. Fiscal policies across the region will remain expansionary in 2024, with a focus on public investment and social spending. However, by 2025, a gradual shift towards fiscal consolidation is anticipated, especially in Slovenia and Croatia, as governments work to manage budget deficits.

06.09.2024.

Regional topics

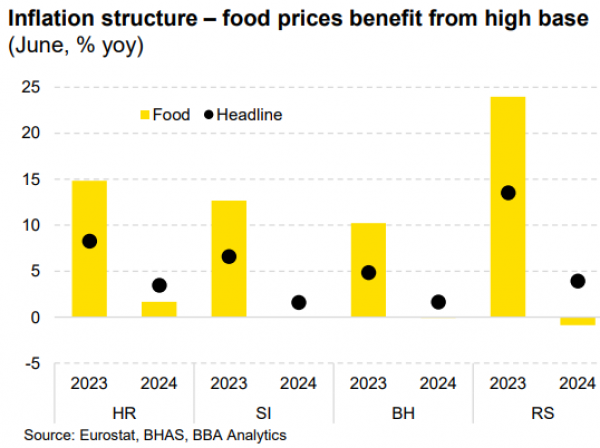

Inflation report - Services running the show

Inflation has slowed in the Adria region, as the prices have been converging to their elevated levels. Calming of external pressures has allowed the prices to relatively stabilize, compared to the previous years. Even though the monetary policies have tightened, the transmission was slow and burdened by high liquidity of the banking systems.

16.08.2024.

Regional topics

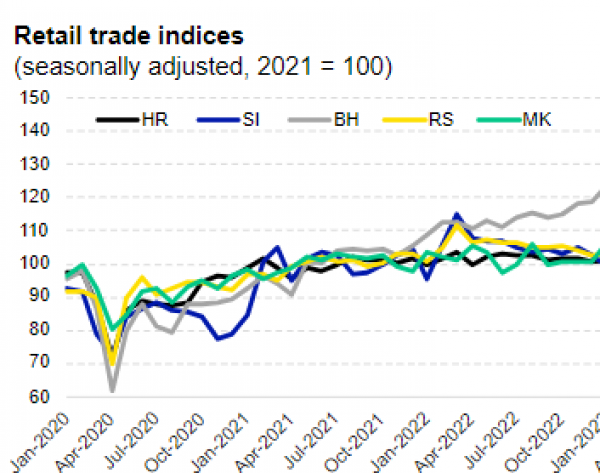

Retail trade - Retail trade rebounding, driven by strong fundamentals

Real retail trade trends are rebounding in 2024, after slower 2023 digits hit by high inflation and uncertainty impaired consumption sentiment. As the inflation slowed down, the spending mood has improved, providing support for the retail trade growth. Spending fundamentals have positive contribution, with growing real wages and employment rise.

26.07.2024.

Regional topics

Adria region metals industry: Corroding sales and razor thin profitability

The largest metal producers in the region felt the sting of the global downturn in metal prices. Sales growth melted away and profitability potential was slim at best. Excess supply arose as the collective industry issue. In this report we dive into the details behind the sales downturns and explore how procurement methods, end user markets and production processes create divergence in performance.

11.07.2024.

Regional topics

Construction and Real Estate - Sector continues to grow, despite chronic labour shortage

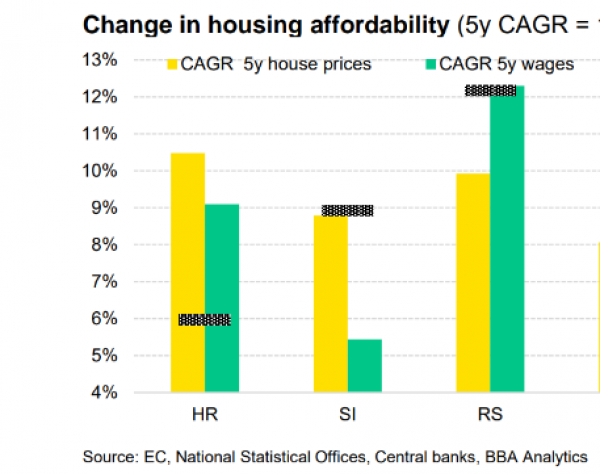

In early 2024, Croatia and Serbia saw double-digit growth in construction, driven by infrastructure projects and earthquake reconstruction, while B&H and N. Macedonia experienced slight growth, and Slovenia's growth slowed due to a high base effect. Labour shortages are a significant issue, particularly in Slovenia and Croatia, leading to increased reliance on foreign workers. Wage growth has improved housing affordability in the last couple of years in Serbia and N. Macedonia but decreased it in Croatia, B&H and Slovenia.

05.07.2024.

Regional topics

Beer industry: Harnessing economies of scale for brewery profitability

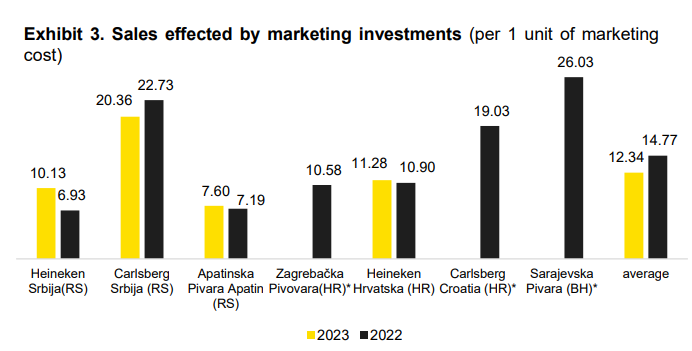

The beer market, both globally and within the Adria region, is one of the most consolidated markets with dominant market players. The Adria region has become an attractive market for global players since 2000, when local beer-producing companies became part of global companies such as Carlsberg, Heineken, and Molson Coors.

28.06.2024.

Company reports

Petrol Group - Navigating regulatory challenges

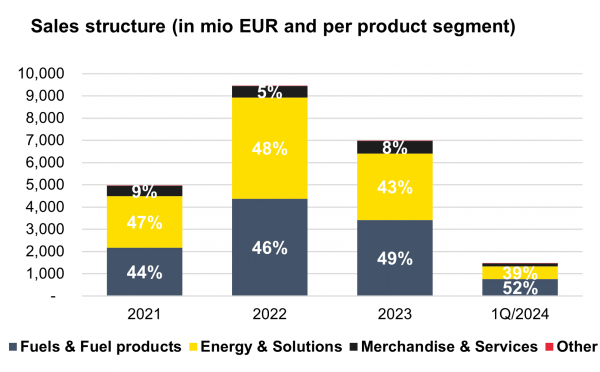

Over the past three years, Petrol has experienced significant fluctuations in revenue and profitability, particularly in 2022, when it achieved a record-high revenues while simultaneously incurring net loss. Despite drop in sales, profitability significantly recovered in 2023. Prices of energy products stabilized below previous year’s level, leading to lower input costs and easing of price regulations. While it seemed that bad times were behind Petrol, it is evident that 2024 will be another challenging year due to new regulation of oil derivative prices.

21.06.2024.

.png)